unemployment tax refund 2021 calculator

The new tax break is an exclusion workers exclude up to 10200 in jobless benefits from their 2020 taxable income. This amount minus your deductions is used.

Tax Calculator 2022 How To Compute Estimated Taxes For Freelances Sole Business Owner Itech Post

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

. You will enter wages withholdings unemployment income Social Security benefits interest dividends and more in the income section so we can determine your 2021 tax bracket and calculate your adjusted gross income AGI. The most recent batch of unemployment refunds went out in late july 2021. July 29 2021 338 PM.

1 You will get an additional federal income tax refund for the unemployment exclusion if all of the following are true. The legislation signed March 11 2021 allows taxpayers who earned less than 150000 in modified adjusted gross income to. When youre ready to file your tax return for 2021 write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1 Additional Income and Adjustments to Income.

Line 7 is clearly labeled Unemployment compensation 3 The total amount from the Additional. Heres what you need to know. After this you should select the 2020 Account Transcript and scan the transactions section for any entries as Refund issued.

By far one of the most devastating economic impacts of the coronavirus crisis is. The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person. This is only applicable only if the two of you made at least 10200 off of unemployment checks.

To reiterate if two spouses collected unemployment checks last year they both qualify for the 10200 tax break. Another way is to check your tax transcript if you have an online account with the IRS. These two things will help us to ascertain exactly how much money or how much of a refund we will be owed.

In short yes unemployment income is taxed. You reported unemployment benefits as income on your 2020 tax return on Schedule 1 line 7. Unemployment income Tax calculator help.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. The IRS will automatically refund money to eligible people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan. This way you can report the correct amounts received and avoid potential delays to.

Unemployment benefits and. The next wave of payments is due to be made at some point in mid-June but until then you may be able to work out how much you will receive. President Joe Biden signed the pandemic relief law in March.

This is available under View Tax Records then click the Get Transcript button and choose the federal tax option. COVID Tax Tip 2021-46 April 8 2021 However a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation. You did not get the unemployment exclusion on the 2020 tax return that you filed.

Choose TaxSlayer and get your maximum refund and 100 accuracy guaranteed. Based on the Information you entered on this 2021 Tax. An estimated 13 million taxpayers are due unemployment compensation tax refunds.

If youre claiming the Child Tax Credit or Recovery Rebate Credit on your 2021 taxes be sure to have your IRS letter for each when you file. Use this 2021 Tax Calculator to estimate your 2021 Taxes. Irs unemployment tax refund august update.

2021 Tax Calculator Free Online. Estimate your refund with TaxCaster the free tax calculator that stays up to date on the. The IRS considers unemployment benefits taxable income When filing this spring your unemployment checks from 2021 will be counted as income taxed at your regular rate.

Individuals should receive a. However paying taxes on unemployment income and understanding how getting unemployment affects your tax return calls for a bit more explanation especially if you want to avoid unpleasant surprises at tax time. You must file Schedule 1 with your Form 1040 or 1040-SR tax return.

Terms and conditions may vary and are subject to change without notice. Restart This Tax Return Calculator will calculate and estimate your 2022 Tax Return. Up to 10 cash back 2021 Tax Refund Calculator Estimate your federal tax refund for free today.

Use any of these 10 easy to use Tax Preparation Calculator Tools. Answer each question by either clicking on the options shown or by entering dollar amounts or other values. But in March the American Rescue Plan waived taxes on the first 10200 in unemployment income or 20400 for a couple who both claimed the benefit for those who made less than 150000 in adjusted gross income in 2020 in light of the coronavirus pandemic.

The 2022 tax values can be used for 1040-ES estimation planning ahead or comparison. Generally unemployment compensation is taxable. These Tax Calculators will give you answers.

The IRS has identified 16. This applies both. Yes No Self-Employment Form 1099-NEC or 1099-MISC.

Basically you multiply the 10200 by 2 and then apply the rate. To help taxpayers the IRS will take steps to automatically refund money in spring and summer 2021 to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan. It is mainly intended for residents of the US.

Unemployment pay1099-G retirement pay 1099-R. This 2021 Tax Return and Refund Estimator provides you with detailed Tax Results during 2022. This handy online tax refund calculator provides a.

And is based on the tax brackets of 2021 and 2022. IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan. Get Your Max 2021 Tax Refund.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312024. The irs is recalculating refunds for people whose agi is 150k or below and who filed before the tax law that changed the amount of unemployment that.

Ad Calculate your tax refund and file your federal taxes for free.

Online Income Tax Calculator Deals 58 Off Www Vetyvet Com

1 200 After Tax Us Breakdown May 2022 Incomeaftertax Com

How Covid Might Impact Your Taxes This Year Rutgers University

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Portion Of 2020 Unemployment Benefits Exempt La Income Tax

Online Income Tax Calculator Deals 58 Off Www Vetyvet Com

Online Income Tax Calculator Deals 58 Off Www Vetyvet Com

Tax Calculator Estimate Your Taxes And Refund For Free

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

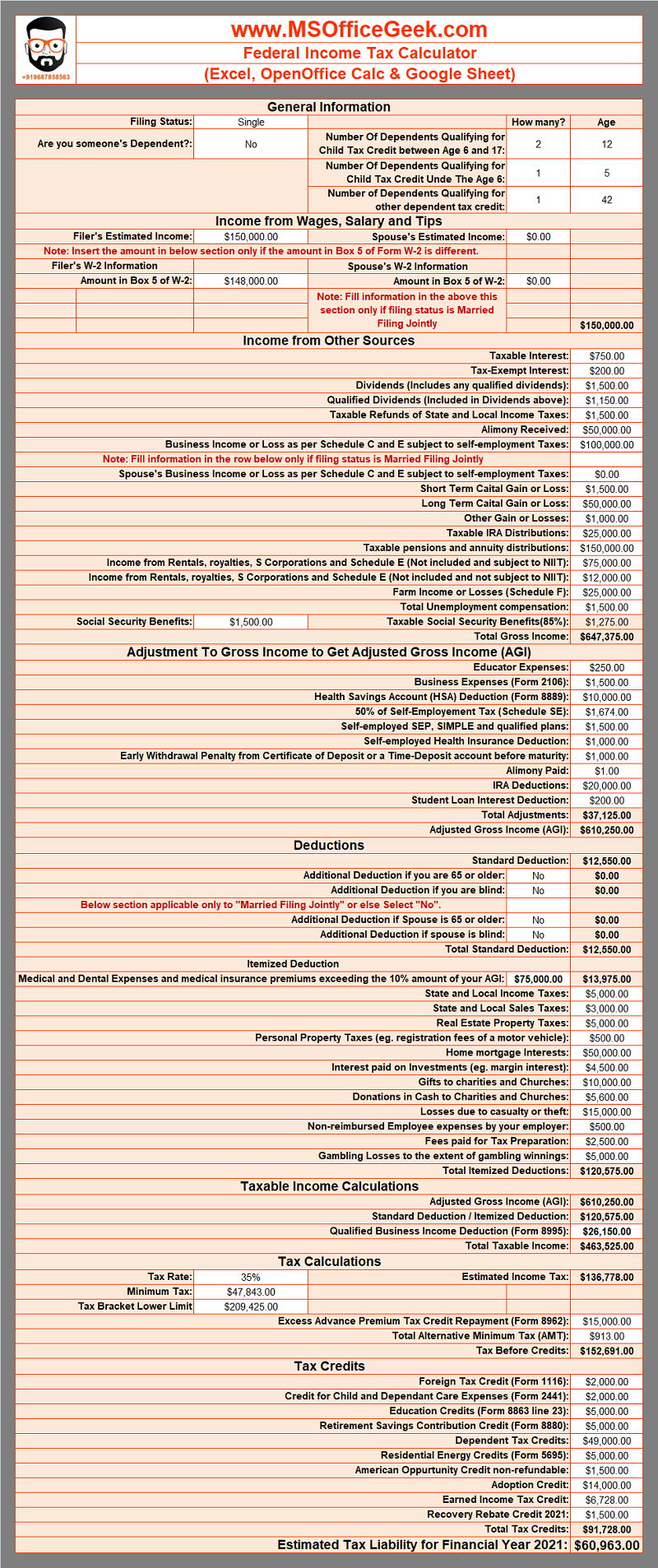

Ready To Use Federal Income Tax Calculator 2021 Msofficegeek

Online Income Tax Calculator Deals 58 Off Www Vetyvet Com

Topic No 203 Refund Offsets For Unpaid Child Support Certain Federal And State Debts And Unemployment Compensatio Internal Revenue Service Tax Refund Topics

Tax Calculator 2022 Federal Income Tax Zrivo

1040 Tax Calculator Home Loan Investment Bank

![]()

Self Employment Tax Calculator Estimate Your 1099 Taxes

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Ready To Use Federal Income Tax Calculator 2021 Msofficegeek

Taxes Calc On Sale 59 Off Www Vetyvet Com

Printable Tax Prep Checklist Tax Prep Checklist Tax Prep Tax Organization